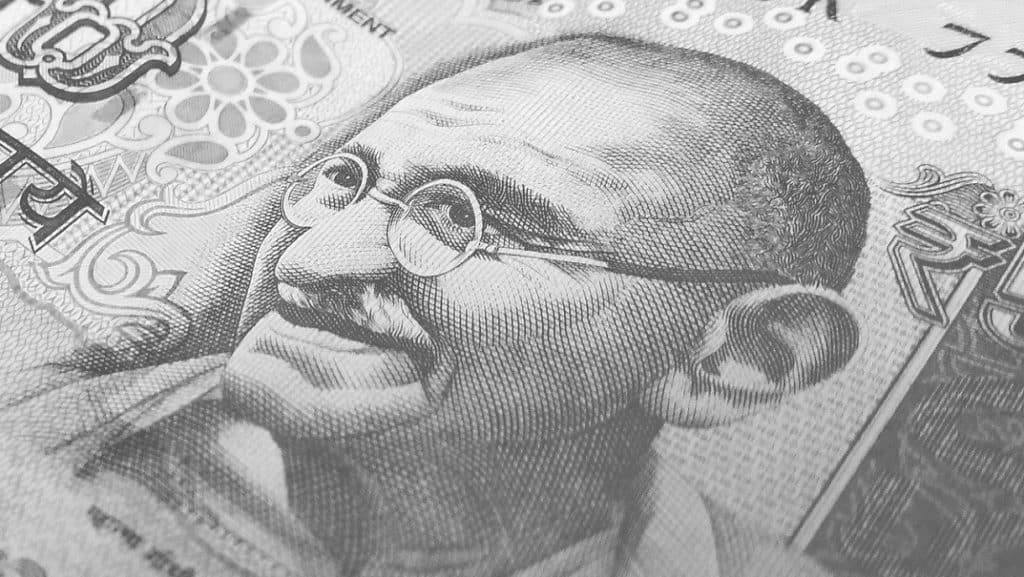

USD/INR- Indian Rupee was at 73.48 as of 03:36 PM IST on 7th September. It opened four paise down at 73.18. The main reason for the fall included the weak domestic equity market. Along with that, foreign traders also pulled out money from the equity market due to the current border stand-off between India and China.

USD/ INR: Oil Prices Slip

The WTI futures fell by 2.3% and was at USD 38.86 a barrel by 00:00 GMT. On the other hand, Brent futures for November fell by 2.1% and was at USD 41.75 per barrel. Oil prices dropped to their lowest since the end of July. Even though the OPEC and other countries have introduced massive supply cuts, the lack of demand has forced the prices to reduce again. The slow economic recovery from the coronavirus is also impacting oil prices as economies take more time to open up.

USD/ INR- Gold Prices

Gold prices increased on Monday. The October gold futures rose by 0.25% to Rs. 50,805 per 10 grams on the multi-commodity exchange. Likewise, Silver futures rose by 1.3% to 68,120 per kg. In the international market, spot gold traded at $1,935.53 per ounce, indicating an increase of 0.2%.

A strong US dollar capped the gains in gold at the global level. But, the rising tensions between the US and China, along with the increasing number of coronavirus cases, helped the gold prices

USD/ INR- Sensex Today

The Sensex started the week off on a positive note. That is, it was up by 0.16% on Monday and saw a 60.05 point increase. Accordingly, it ended at 38,417.23 at 3:40 PM IST on 7th September. Similarly, the NIFTY saw a rise of 21.20 points or 0.19% and finalised at 11,355.05. Bharti Infratel and HDFC Life were some top gainers whereas Bajaj Finance and NTPC were some top losers in the index.