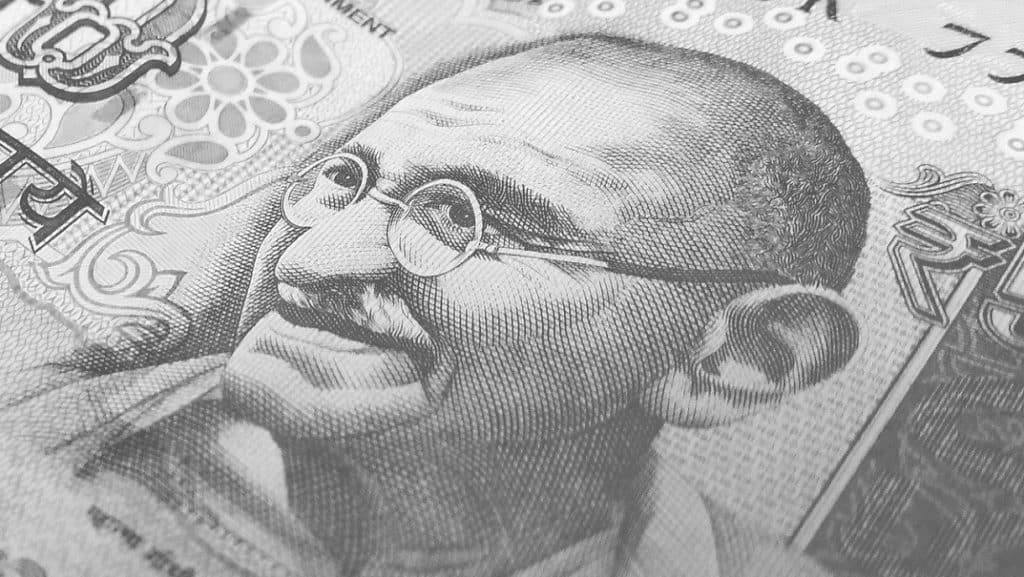

USD/INR- The Indian Rupee value fell again at the beginning of the week and is trading at the 75 range. Accordingly, it settled at 75.35 on 21 April. The fall in rupee value is mainly attributed to the surge in COVID-19 cases and RBI’s unchanged repo rates. The Indian rupee traded between 75.439 and 75.420 today. On the other hand, the dollar index decreased today. Accordingly, its value fell and settled at 91.07 as of 10:11 PM EDT Wednesday.

Why is the Rupee Value Plummeting in the Recent Past ?

In a matter of 3 weeks, the rupee has dropped down over 4.3%, making the Rupee one of the biggest loser. Alongside the Indian rupee, Turkish new Lira, Brazilian real, Russian Ruble, Thai Baht, and Indonesian Rupiah have lost value against the US Dollar. As mentioned earlier, the two main reasons for the fall in Rupee is the growing COVID-19 concern and RBI’s monetary policy. Also, the concerns over the pace at which the economy is recovering have affected the Rupee. Further, the positive growth pattern of the US Dollar has put pressure on the Indian currency. In addition to that, the RBI’s G-SAP programme for liquidation tumbles the currency. Another final factor is the foreign investor pull out that dwindles support and attributes to the fall.

USD/ INR: Oil Prices

The US WTI crude oil prices decreased on Wednesday as well. However, with the ongoing oil demand concern and the growing coronavirus pandemic, it is highly uncertain. Also, recent studies predict that the oil demand will not reach the pre-crisis level until 2023. Accordingly, crude oil decreased by 0.83% at 8:05 PM on 21 April to trade at USD 60.84 per barrel globally. At the same time, Brent Crude was set at USD 64.81 per barrel and traded at a rate of 0.78% lower today.

USD/ INR- Gold Prices

Precious metal prices rose amid the resurgence of COVID-19. Accordingly, gold futures increased by 0.77% or 367.00 Rupees to settle at 48224.00 per 10 grams on the multi-commodity exchange. Likewise, Silver futures rose by 1613.00 Rupees or 2.35% to settle at Rs. 70358.00 per kg. The resurgence of the COVID-19 pandemic and the COVID-19 mutants kept precious metals’ prices on edge this year. In the international market, Spot Gold was trading at USD 1789.20 per ounce in New York. On the other hand, Silver traded at USD 25.95 per ounce.

USD/ INR- Sensex Today on April 20

The BSE Sensex fell and ended in the red on April 20 for the second consecutive day. Accordingly, Sensex decreased by 0.51% or 243.62 points. Thereby ending the session at 47705.80 at 4:10 PM IST Tuesday. Similarly, the NIFTY decreased by 0.44% or 63.05 and ended up at 14296.40. The stock market was closed on April 21 on the occasion of Ram Navami.