Partnership firms governed by partnership deed are strong forms of business structure that enables accurate division of profit among the partners. Contrary to a sole proprietorship, this establishment is headed by a group of volunteered individuals supporting a common business agenda. Thereby, the agreed terms and profit beneficiary ratio minimizes the compliance as opposed to companies. Besides, its an easy organization structure to form.

Salient Features of a Partnership Firm

- Formed on mutual agreement called Partnership Deed

- Righteous business activity

- Apt shares of profits and loss between partners

- Liability between partners

- Clear and collective management

- Clear transfer ability clauses

- Registration (optional)

- Specified duration

Understanding the Pros and Cons of a Partnership firm

As stated before, partnership requires minimal compliance. For instance, it is excused from filing annual tax returns along with publicizing the financial statement of the firm. Further, auditing work isn’t mandatory. On the other hand, the partners do not acquire liability protection and don’t have eternal survival in the firm.

Additionally, the structure does not encourage investment from Angel investors, Financiers, or Private Equity units. Also, the rates of banks lending money to companies are higher than the Partnership firm.

Starting a Partnership firm

Consider the following things while starting a firm

Name of the firm

The name can be chosen by the partners keeping two points in mind

- Name must not be too familiar or identical to any firm that is in existence.

- The name should not contain words (king, emperor, crown) that require government’s sanction.

Partnership Agreement

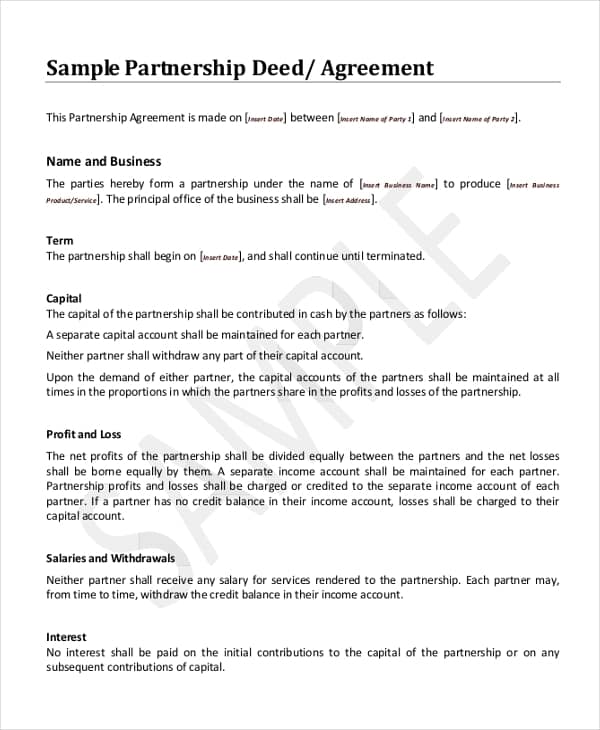

The agreement among the partners of the firm that encompass rights, responsibilities, profit shares, along with all the necessary obligatory clauses is the Partnership Deed. Emphasize that, a deed must be written and signed (opposed to agreeing orally) to avoid future conflict. The necessary information to formulate a deed are:

General details and Specific information

- Name, address, nature of business, date of establishment, capital invested (separately by each partner), profit or loss division ratio.

- Interest-based on the capital investment OD each partner

- Salaries including all financial drawing by the partners

- Rights, Duties, and obligations of every partner specified by name

- Alignments in case of mishaps such as defaults or death of a partner

- All the clauses mutually decided among the partners

Registration of the Partnership Firm

The registration of the partners is optional, thereby dividing the firms into a registered firm and non- registered firm. Despite that, the firm abiding the Indian Partnership act, 1932 governs the associates of the firm.

Even though, registration is not mandatory it is advisable because

- The firm will not have a legal stand against the third party in any case

- In the case of misconduct or disagreement, a file can not be registered against the partner.

- The liability of an unregistered firm is less

Documents Necessary for Registration

As discussed earlier, any firm is not legally perceptible unless it is registered. Hence, these following document:

- Application form for registration- Form 1

- Sample of Affidavit

- Partnership deed copy

- Address proof (for the place of business)

- Partners documents- PAN card and Address proof of each individual

- Firm documents- PAN card (specially generated for the firm)

- Supporting Documents- GST registration and Current account details

Registration Procedure

A very simple process is used to register the Partnership firm. That is

- Initially, issue the application form

- Fill the form with adequate data and subsequently sign (by all partners)

- Further, submit the form to Registrar of Firms of the state where the business is located

- Finally, payment of fee

- Additionally, submit necessary documents

Following that, the official analyses the documents for accuracy. Subsequently, if the documents are factual, the officials issue a Certificate of Registration in the name of the Partnership firm.