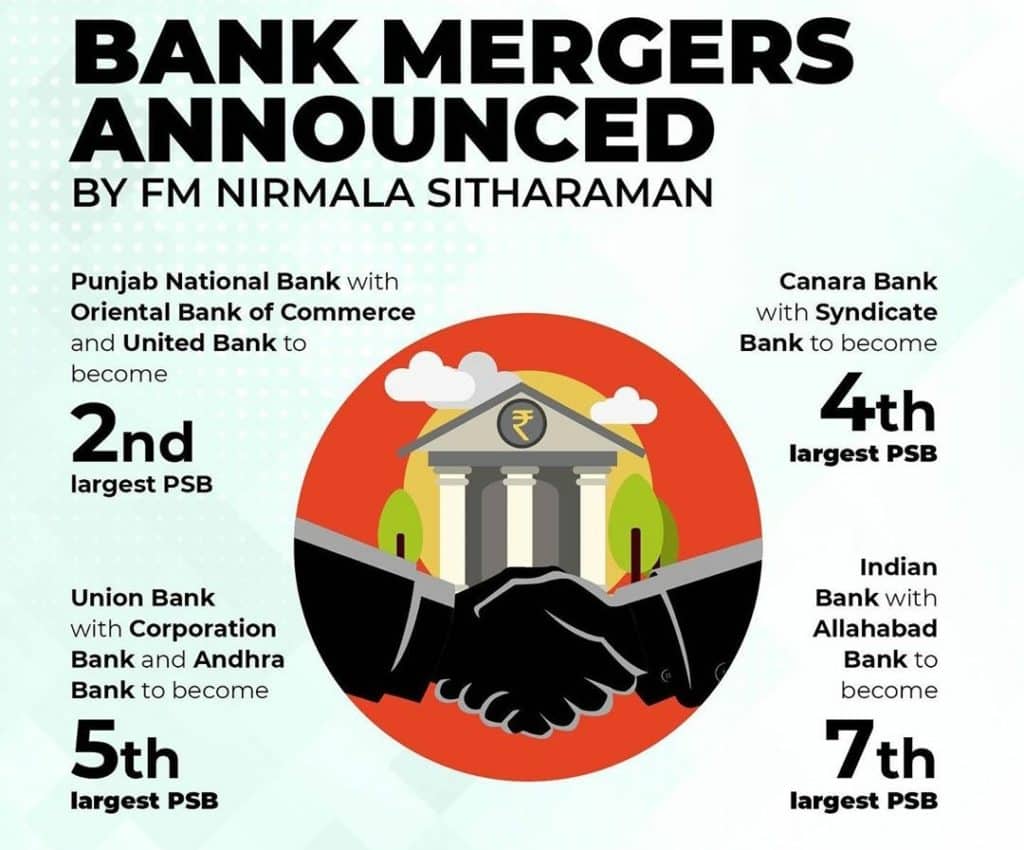

Government’s decision to merge Ten Public Sector Banks (PSB) into Four is a matter of debate across the nation.

Syndicate Bank merged with Canara Bank

Andhra Bank and Corporation Bank merged with Union Bank of India

Allahabad Bank merged with Indian Bank

Increased Capital Adequacy

The government claims that the move will boost Indian economy and optimize lending ability. This could help in managing the government finances better for capital strain to lenders. This is profitable to bigger banks if we speak of capital adequacy. Except Indian Bank, all other PSBs have lower capital adequacy than the ones they are being merged with.

The plan promises to provide greater credit disbursal and clearer and strong structure to the banking system. Indeed, the merger would give a strong banking structure it would ease the in monitoring and increase the lending capacity of banks.

Shares Tumbled by more than 16% since Announcement

The move may reap long-term benefits but after the announcements of merger the shares of Public Sector Banks tumbled by more than 16%. Investors are opting out of public bank as there is no clarity on the merger ratio, and it the major reason behind fall in the stock prices. To bring out the merger successfully in technical front, it may take more than 3 years.

The Verdict

In FY 2018-19, the government infused INR 1 trillion in Public Sector Banks that helped Bank of India, Oriental Bank of Commerce and Bank of Maharashtra to exit from RBI’s prompt connective action framework (PCA) in January.

PSB merger might have long term benefits but the previous merger of Bank of Baroda with Vijaya Bank and Dena Bank tells a different story. This merger didn’t fructify as the shares of Bank of Baroda are under constant pressure.

The implementation of the merger is quite a complex process. The monitoring of all the balance sheets and carrying out the technological changes is strenuous task. If implemented efficiently, it could possibly spur economy and help the country reach the $5 trillion GDP target. As of now there is a possibility that people would shift to private banks, though some may hold on to benefit from the scheme. However, the process is critical and has the potential to turn Indian economy upside down based on the implementation.