GST Registration is compulsory for companies with turnover over Rs 40 Lakhs and Rs 20 Lakhs for special category states. Sellers are obligated to register themselves for Goods and Services Tax (GST) since 1st July 2017. The said GST is a form of indirect tax in India and encompasses categories like service tax, excise duty, entry tax, and customs duty into a solo tax scheme. Accordingly, it envisions to reduce the complexities in the tax returns while carrying out business. Further, the complete enrollment process is paper-free, which is taking place online. On registration, the applicant will receive a unique identification number- GSTIN. Consequently, the number from the central government is a region-specific 15- digit number.

Benefits of GST Registration

Any individual enrolled for GST will enjoy the following benefits:

- Legal goods or services suppliers

- Legally sanctioned to collect tax from customers and thereby, pass on the credit of the taxes collected on the goods or services provided to the procurers or recipients

- Privilege to avail the input tax credit of taxes paid on the gains

- Furthermore, can exploit the same at the expense of taxes owing on the supply of goods or services

- Uninterrupted movement of the Input tax credit from dealers to receivers at the national level.

- GST Refund for Exporters.

GST Turnover Limits

Irrespective of the limit certain entities like individuals using e-commerce for supply, non-resident or casual taxable people must obtain GST registration. That apart, the general limits are listed here on:

- Service Earners: Over Rs 20 lakhs per year is necessary to obtain GST registration. Further, in a few selected states, the limit is Rs 10 lakh.

- Goods Dealers: Over Rs, 40 lakh per year is the limit set in this case. Additionally, rules such as not be a service provider, not deal in few states, and should not supply ice cream, tobacco, or pan masala are applicable

Special Category Status: the states under this category are: Arunachal Pradesh, Assam, Jammu and Kashmir, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, Himachal Pradesh, and Uttarakhand.

Important Reasons for GST Registration

Regardless of however small the business, many vendors enroll themselves for the following reasons:

- As it enhances business reliability and integrity

- To mollify the necessities of B2B customers

- Importantly, to avail the benefits of Input Tax Credits

Rules and Responsibilities to Follow After GST Enrolment

The units under GST are entitled to certain responsibilities, such as:

- Accumulating and forwarding GST expense from customers

- GST invoice- Issue duly as per GST guidelines

- Fill appropriate GST returns per annum

- Maintain all record in the archive for future references

The necessities when registering for GST

- PAN card

- Identity card (Voter or Aadhar card) of Director/Proprietor/Partner

- Contact details proof (Phone number and email address) of Director/Proprietor/Partner

- Place of business proof

- Supporting documents (Property Tax receipt, Electricity bill, Municipal Katha copy, Rent or Lease agreement copy, and consent letter)

- Additional proof of business, if any proof of the same

- Active bank account number

- Bank Account statement

- Goods and Services list

- Letter of Authorization

- Signatory photos that are authorized

- For company: Incorporation certificate. For Partnership firm: Partnership deed

- Professional tax (optional)

- State expunge license (optional)

Stepwise instruction on of GST Registration process online

Emphasized earlier, the whole GST Registration process is digital and thus does not waste paper. Therefore, on registration, no hard copy will be given out.

GST Application Form-

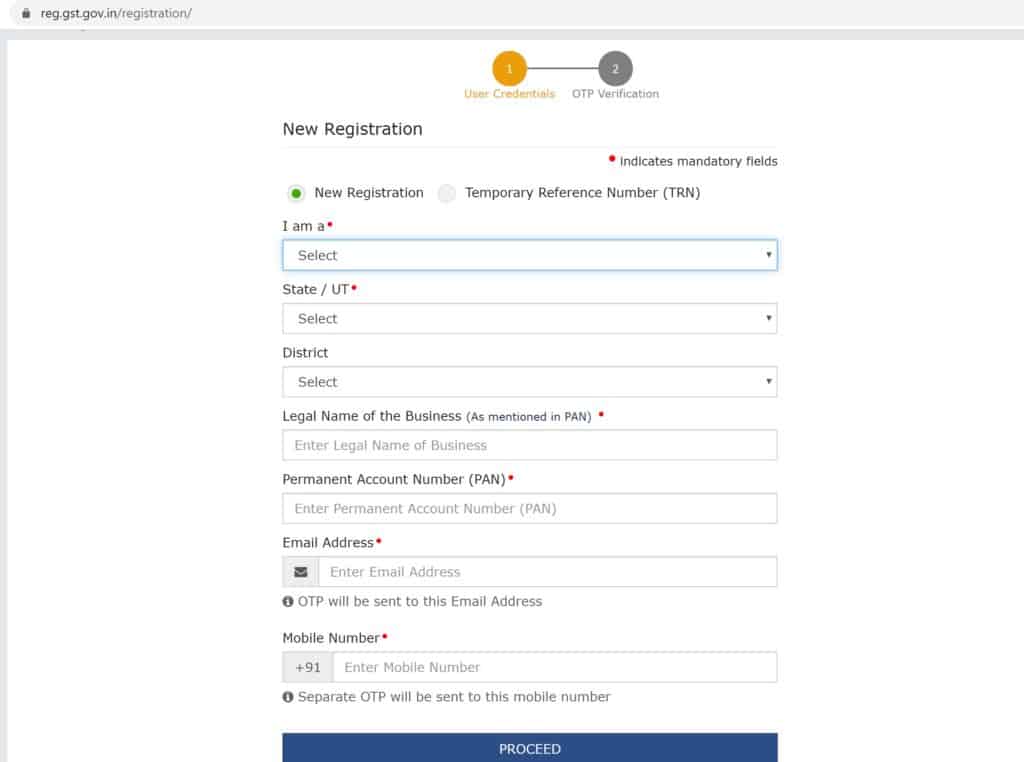

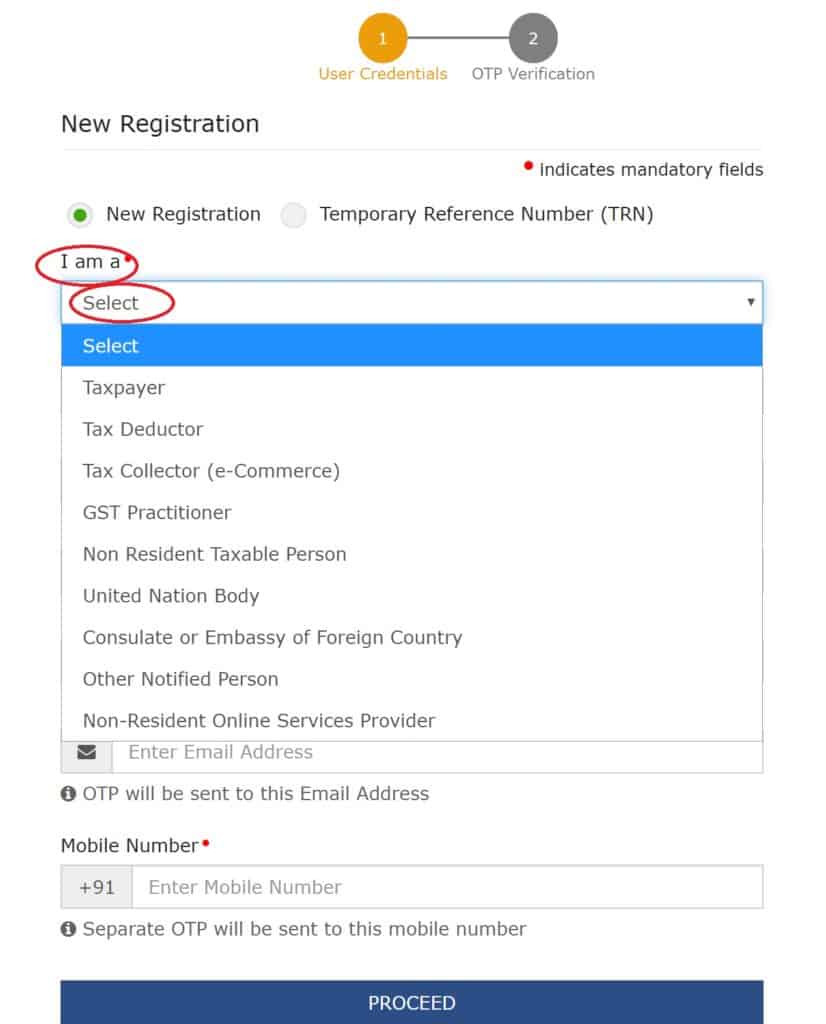

This step is issuing of the Temporary Registration Number (TRN), this requires a phone number, PAN, and email ID

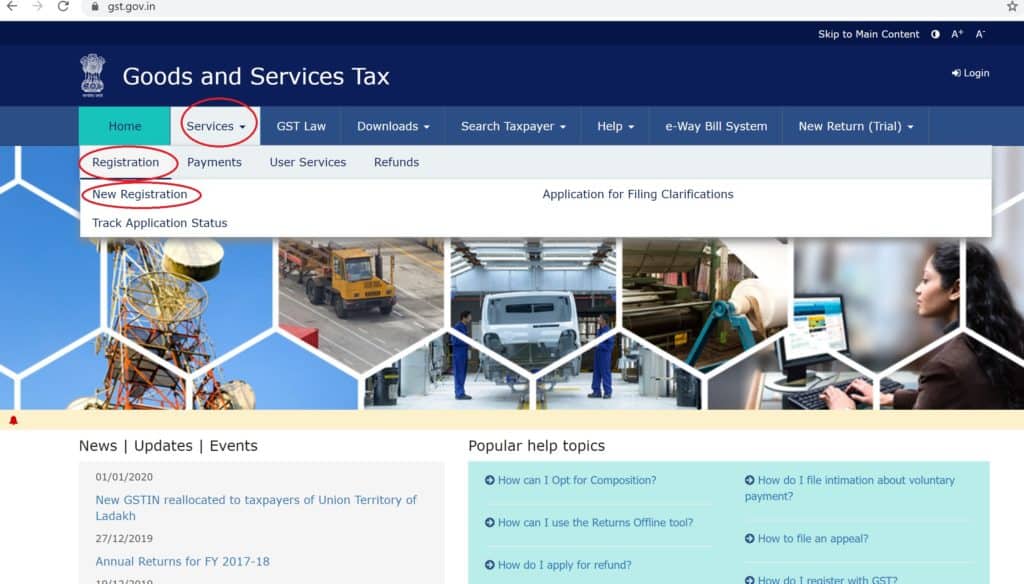

- Visit the website- GST portal. Click services and choose a new registration option under registration.

2. Following that, fill the fields in the page duly (PAN card, contact number, and email ID)

3. Subsequently, verify using the OTPs received in email and phone respectively (Valid only 10 minutes)

4. Next, the TRN will be generated

5. Use the TRN to log in again in the same manner “Services> Registration> New registration> TRN number.

6. Enter the TRN number and the captcha text in their respective fields

7. Once again, verify using OTP (New OTP, not the previously generated one)

8. This will lead you to “My saved application”

9. Fill the same and submit within 15 days. In other words, the website automatically deletes the details and one has to start from the beginning after 15 days.

Filling the GST Application Form-

Care must be taken to fill all the fields with correct information

- First, fill all the information and save while ensuring the info as correct, the information will be regarding the name of the company, PAN details, State of registration, Date of commencement of corporate and additional basic details

- Enter details of partners or proprietor or directors as the case maybe. The data will be regarding personal details, designation, Director Identification Number (in case of company), PAN, and Aadhar card

- In case of additional place of business extra info such as place of the company, establishment day, etc.

- Make sure all the highlighted fields are filled duly

- Following that, provide proof for the constitution of the establishment

- Next, fill in the Official Signatory information this can be by DSC or e-sign, also DSC should be in link with PAN

- Further, fill info regarding Primary Place of dealing, Goods and services and Bank accounts.

Verify and Submit GST Application–

Verification can be by three methods- by DSC, by e-signature and by EVC. Subsequently, submit the application. Following that the applicant will receive an Application Reference Number (APN) via SMS and email. This is an indication to confirm the registration.

After the submission, it will take about 5 to 10 days to obtain a GST certificate. In such a case, the status will change to approved. Accordingly, generates unique GSTIN along with login and password details to log into the GST website. Consequently, after 3 to 4 days after receiving GSTIN, the applicant can download the GST certificate.

Download GST Certificate

Go to the same website, and click on services. Next, choose the User services options. Following that will lead to the view and download option, click on the Download option and obtain the certificate.