The bad loans under MUDRA scheme are rising at alarming levels, depicting a dismal in the banking industry.

MUDRA Scheme

Launched by PM Modi in April 2015, Mudra-Micro Units Development and Refinance Agency is an institution that works under Pradhan Mantri Mudra Yojana. It aims to provide easy credit without collateral to small/micro-enterprises. It issues loans up to Rs 10 lakh under three different categories in partnership with several financial institutions and banks. Categories include Shishu (Up to Rs 50,000), Kishore (Rs 50,000 to 5 lakh) and Tarun (Rs 5 to 10 lakh).

NPAs of banks

The MUDRA scheme, however, has turned a headache for the banks. Minister of State for Finance Anurag Singh Thakur informed in a session that out of ₹6.04 lakh crore disbursed as loans by scheduled commercial and regional rural banks since the start of the scheme, ₹17,251.52 crores (2.86%) had converted into NPA’s. PNB topped the list with the highest NPAs of Rs 1600 crore (8.11%) out of ₹20,000 crores under MUDRA scheme. On the other hand, SBI distributed loans worth ₹1 lakh crore under MUDRA scheme. Making it the highest disbursement with only 2.65% as NPA’s. Public sector banks wrote off Rs 1,86,632 crore as NPAs in FY 2019. He further stated that the government will solve the issue of financial institutions of not accepting applications and demanding collateral for giving loans.

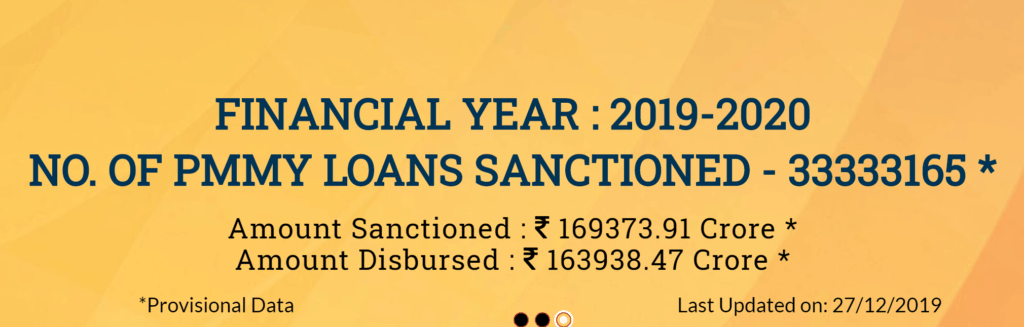

Dhanalaxmi Bank and Federal Bank topped the highest NPAs above 10% among the private banks. Regional Rural Banks had 3.86 percent of Rs 2000 crore turned into NPAs. Finance Minister Nirmala Sithraman declared that more than 20.65 crore loans worth ₹9.86 lakh crore had been disbursed since the inception of the scheme till 25th October 2019.

Suggestions

Citing the increasing number of NPAs under MUDRA scheme, many experts advised the banks to carefully analyze the repaying capacity of the borrower before providing loans. The banks demand to improvise the scheme immediately before turning it into a systemic crisis. Many experts believe that inefficient risk assessment accounts for loans turning into bad debts.

In conclusion, poor underwriting and pressure to meet targets have added to the problem. The policy needs a revision to prevent turning of the banking industry into a mess.