Schemes for export of agriculture commodities from India include MEIS, Duty Drawback and Transport and Marketing Assistance. Government of India promotes export of agriculture commodities by promoting various schemes. Additionally, these schemes have a significant impact in increasing farmer’s income.

Agriculture commodity export declined recently despite the increase in 2016-17 by 2.64%. Export of a few significant agriculture commodities declined in 2019. For instance, basmati rice faced a downfall of 7.75%. Similarly, cotton declined by 16.38% and buffalo meat met a 4.07% decline. The reason for fall in agriculture export included global economic slowdown, hindered currency movement and high competition in international prices.

Agriculture Export Policy

This policy originated intending to improve India’s opportunities in the global market, and alongside increase farmer’s income. Consequently, a few major objectives of the policy are as follows:

- To expand our international export market and encourage agriculture exports.

- Promoting Agriculture produce that is novel, native, ethnic, and organic.

- To stipulate an official mechanism that helps ease the flow in terms of market access, overseas barricades, hygienic and phytosanitary processes.

- Most importantly, to benefit the farmers of the nation.

- Aims to double India’s portion in world agriculture exports by participating in the universal value chains.

The Government along with the Department of Commerce have introduced Schemes for Export of Agriculture Commodities:

Merchandise Export from India Scheme (MEIS)

MEIS is under the Foreign trade policy of India for the year 2015-2020. This scheme encourages exporters by providing numerous rewards and inducements. However, the incentives differ from merchandise to merchandise in the range to 2 to 5%. Similarly, vary from country to country based on the specific FOB value. Further, the incentives issued will be in the form of Duty Credit Scrips (DCS) that are transferable. DCS must be applied before 12 months of Export (LEO date) and valid till 18 months from the issue date. Additionally, the DCS can be used for the payment of customs duty.

It must be noted that agricultural products receive the highest rewards under the scheme. Equal importance would be provided for village oriented industrial products. Further, major markets such as herbals, pharmaceuticals, surgical requirements and so on are also supported.

Procedure for Applying for the MEIS Scheme

- The online application is filled in the ANF-3A format with a digital signature.

- This must be filled under the concerned Regional Authority of DGFT. Further, it is mandatory to fill separate forms for each port of shipment. A limit of 50 shipping bills is set on each application.

- The relevant documents such as shipping bill and e-RBC must be linked to the online application in case of EDI submission. However, in the case of non-EDI documents such as a hard copy of export promotion of non-EDI shipping bills and proof of landing must be submitted.

- All documents are required to be maintained in the exporter’s possession for 3 years. In case of a mishap, these documents are requested and in case of misplacement, the rewards along with interest must be refunded back to the government.

- Let export date is considered as the relevant date for understanding the eligibility of the product, ITC code, and markets for claiming rewards under MEIS.

This procedure holds goods for all kinds of claims expect claims under e-commerce.

Procedure for Claiming Incentives

- The online application is filled in the ANF-3A format with a digital signature.

- Submit express operator landing certificate or airway bill no from online web tracking print out. This is submitted as proof of landing.

- Like the other case, it is mandatory to fill sperate forms for each port of shipment.

- These documents are crosscheck manually by the RA before granting the scrip.

It is important to determine the Jurisdictional officer of DGFT before applying. It is also emphasized that once chosen, the action cannot be changed.

Transport and Marketing Assistance (TMA)

The administration brought a new scheme scheme for export of agriculture commodities . This is the transport and Marketing Assistance which offers assistance in international export. The scheme aims to provide ease in the export of agriculture commodities providing assistance in freight.

A Brief Procedure for Claiming TMA

- An exporter is eligible to fill the application form by having an RCMC received from the Competent Authority.

- A corporate office/ registered office/ Head office/ Branch office or the manufacturing unit can make the application. Like e-commerce, this would be addressed to RA of the DGFT. Further, the exporter chooses the jurisdiction during the first application and this shall not be modified later.

- The online application is filled in the DGFT website and the fee as mentioned in Appendix- 2K. It is important to fill the relevant documents along with ANF-7(A)A within 30 days concerned with RA.

- The application is similar to other ECOM applications and provides a unique number on submission.

- Applicant claims are quarterly based, it is important to follow the basis by filling the form within a year. All the consignment shipped in a quarter must be submitted together.

- Failing to submit any relevant documentation will result in rejection of the claim.

Important Documents

Failing to present any relevant document mentioned below will result in the rejection of the claim.

- EP copy of the Shipping Bill

- Commercial Invoice

- Bill of landing (in case of shipment by sea route)

- Certificates concurred from Chartered Accountant (CA)/ Cost or work Accountant (ICWA)/ Company Secretary (CS) as per (Annexure A)

- Proof of landing (Annexure B)

In case the RA finds any discrepancy in application or documents during examination, the claim will be rejected.

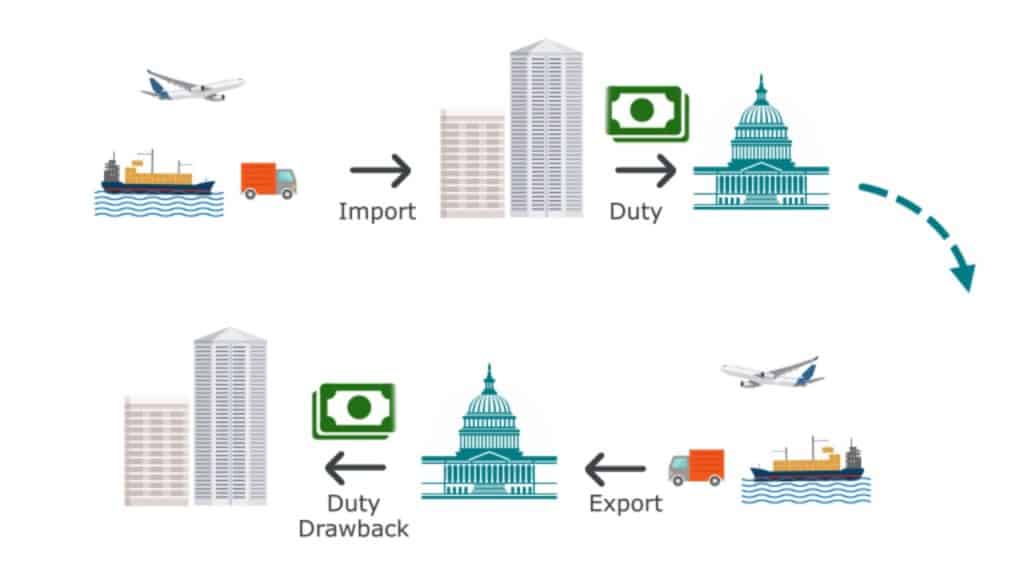

Drawback Duty

The drawback duty is the repayment of duty of customs and duty of central expunge. These duties are charged on trading or production of the goods that are exported.

The types of Drawback duty

- All Industry Rate (AIR)

All Industry Rate (AIR) for drawback duty is provided by the government. Rates are set after discussion with all the stakeholders including export commission council, trade associations and exporters. For AIR they take into consideration the procurement prices, duty rates, Fob values, consumption ratios, etc. The AIR of Duty Drawback is fixed as a part of Fob price of the shipment. Subsequently, the AIR claim is usually carried out by the EDI scheme.

- Brand Rate of Duty drawback

If the commodity exported is not listed in drawback schedule then the exporter is eligible for Brand Rate Duty Drawback. In case the exporter feels the duty drawback rate is insufficient compared to duties paid by the exporter they can avail brand rate duty drawback. In this case, the exporter must produce evidence of payment of duty and actual inputs in production of goods. The exporter should make an application to the commission of jurisdiction within 3 months of Let Export order. The commissioner will examine all the documents submitted and issue and approve brand rate letter accordingly.

The requirements necessary to claim the drawback are:

- The goods must have been formerly imported and must be identified as imported.

- Import duty must be remunerated when they were traded in.

- The goods must be entered for export within two years of import.

- The goods must be exported outside India.

- The amount claimed must not be less than their market price

- The amount claimed must not be less than Rs 50 as per Sec 76-(1) (c) of taxes act.

The main concern of drawback duty is the delay. As a result, it increases the cost of the operations and working capital issues in exporting companies.